Friday's last five minutes provided a rocket fuel boost to markets going sideways. It was confounding to say the least. If you think those last five or ten minutes smacked of conspiracy theory and a secret cartel trying to prop up the markets, you have a rather large company. The flaw in this theory is that such an action and the immediacy of its effects are too conspicuous and contradict the very definition of how a cartel works. If you want to call the government, the Fed and the treasury as the cartel, then you are right. The actions they are carrying out are really not that clandestine either - whether it is printing money, cutting the rates, tax breaks, triggering spending, launching massive liquidations through treasuries. Which one of this action is truly a secret? None. That is not to say some amount of program trading activity or even government assisted trading activity does not exist. But I feel to attribute all of the weird behaviour of the market to some kind of secret Area-51esque style machinations may be over stretching. Lets wait until more evidence comes through before we declare that everything under the sun is orchestrated and aliens run the US government. In the meantime, you can still find several opportunities to benefit.

Rainsford Yang at MarketTells.com has done an excellent analysis in his latest market commentary on the surges in the final few minutes. He has found that such a surge has actually happened eighteen times in the last nine months so it is not exactly a new phenomenon in recent times. However when you expand your horizon to the last five years, this behavior does appear as new. I asked him if he thought that principal program trading activity was the main culprit behind Friday's activities. His response - "(It is) certainly true that principal program activity (initiated by the likes of GS, etc) has been unusually high recently. But I don't think that's the reason for the last-minute craziness. We saw similarly heavy principal program activity back in 2004 & 2005 - see http://markettells.com/wp-content/chartsO0O/prgtradelt.gif - yet there were never the kind of final-minute moves like we've seen recently."

Updates on Open Positions:

My trades that I post on Twitter are doing well. My current open positions are VIX long, FAF short, CMCSK short, IMAX long. Other than IMAX, the other three trades are short term and I may be looking to get out soon given the continuation of choppiness in the markets.

Let me share my thoughts on IMAX. IMAX is a long term play and I have conviction in their growth story. This is just the beginning of their growth. With the advent of ginormous sized LCD TVs and home theater systems, the incentive to go to a theater can only be provided by something more obscenely ginormous and monstrous. This simple logic has lot of teeth in it and what makes IMAX so lucrative. Sweetening the deal further is the exponential increase in the rate of movies going the IMAX way.

I will be first to admit IMAX is speculative at best. The valuation and debt picture have received bad grades from analysts. But what is not being accounted for is the upside surprise in terms of growth. And that to me has a telling weight that underscores the IMAX story.

Having said all of this if IMAX makes an abnormally large move to the upside, I may not wait and bank some coin.

Good luck

Sunday, May 31, 2009

Friday's Action and Updates on Open Trades

Posted by

Krish R

at

11:03 PM

0

comments

![]()

Monday, May 18, 2009

Whipsaws

It's become choppy in the last few days. I am posting my trades on Twitter. So far I am in black thanks to nimble shifts in the outlook as the markets whipsawed.

Admittedly there is confusion because of contradicting economic data, credit crisis still looming large and general lack of consumer confidence. However it is important to differentiate the triggers for short term trading from the indicators that shape the longer term macro economic views. To that end, Dr Brett has written a pithy but wonderful post. Check it out.

Posted by

Krish R

at

7:15 PM

0

comments

![]()

Tuesday, April 28, 2009

Update and Twitter

Folks, I have been gone for a while. Sorry about that. Anyways, a few quick updates. I am on twitter and you can follow me here or you can see the updates on the right hand side on this Blog.

As some of you already know I sat out most of the market rout beginning November of last year (phew!). Am back trading but not so very often. However after becoming reckless with my portfolio last year letting it to rot with no active supervision, I am making the choicest of cuts thus trying to yield more profits.

My call for the Markets: we are seeing a very interesting mix of indicators between sentiment, put-call, weekly charts, options volume and Tick. I am Market neutral. I don't know if you have noticed but since the last three weeks we have had a pattern of up Fridays followed by down Mondays. As long as this continues, you can be assured we will remain in an uptrend purely from a pattern recognition point of view. However, there is a lot going on in the short term that makes it wise to play very safe.

If you read my twitter updates, my last few trades have been decent. I am currently short Nasdaq through QQQQ puts since end of Friday and will remain so until tomorrow or day after. After that I will take them off the table and be on the sidelines unless a clear pattern emerges in either direction.

Posted by

Krish R

at

1:08 AM

0

comments

![]()

Sunday, July 20, 2008

Market Notes

I covered all my S&P shorts past Friday. Needless to say holding the shorts for the last four weeks turned out to be a profitable venture. Do I think the market is not going down from here? I did not say that. But the degree of confidence in market direction for short term has decreased. Meaning the market could continue its current rally. However for short term, I see some volatile swings in the offing and you have to have nerves to digest them especially if you have position trades open overnight. That said, there is still a good deal of confidence that trend is still down for long term at least for now. Why not take some profits off the table and play with the extras on other trades I feel more confident about? In fact I will cover one such trade in the next post following this one soon.

Going back to market direction, if oil keeps going lower and dollar keeps moving higher or even remains stable, this will add to the impetus the market needs to continue its rally from here on.

Good luck

Krish

Posted by

Krish R

at

11:10 PM

0

comments

![]()

Tuesday, July 15, 2008

Do "Increasing Volume" in Short ETFs Really Justify Lower VIX?

Recently there have been several articles that are trying to justify the relatively lower values in VIX with respect to calling market bottoms. One of the biggest reason thrown out there has been the "surging volume" in index ETF shorts. Examples - short ETFs from the Proshares Funds' ETFs - SDS, QID, SH, etc. aka ultrashort S&P, ultrashort QQQ, short S&P, etc. The argument is because these short ETFs are gaining popularity and volume, they are acting as a more known and well embraced hedge against the broader based portfolio. So far so good. But then it goes on to reason that this phenomenon has resulted in panic mitigation in equity stocks, which is what sentiment indicator like VIX tries to measure in a broader manner. Ergo, VIX is not flying at high values that you typically see at Market bottoms especially in the last one year.

I disagree. Why? The facts don't support the popular hypothesis. I went back to the last two intermediate bottoms (Jan 22 and March 17) and compared the volume of several short and ultra short ETFs with the volume in recent days including today when we saw something of a mini spike in VIX earlier in the morning. Let alone being significantly higher, the volume in these ETFs recently has been generally less than the previous two bottoms! I also looked at the average volume to ensure I was not focusing on too short a window and still it wouldn't confirm the fact that the average volume traded has been consistently increasing as compared to Jan and March bottoms.

Well a picture speaks a thousand words. So lets take the example of Ultrashort and Short ETFs for S&P and DOW offered by Proshares

The first figure above compares the total volume traded for Ultrashorts within three days of January 22 and March 17 with the Mid July timeframe. The blue bars represent SDS (Ultrashort S&P). The red bars represent DXD (Ultrashort Dow 30)

As I said, pictures speak volumes. Example a total of about 145 million SDS shares traded on Jan 18, 22 and 23, with Jan 22 being the midpoint of January bottom in Markets. A total of about 138 million SDS shares traded on March 14, 17, and 18, with March 18 being the midpoint of March bottom in Markets. And get this, a total of only about 127 million SDS shares have traded on July 11,14 and 15 when we saw the biggest spikes in VIX since the March bottom. Shouldn't the volume on July 11, 14 and 15 have traded higher not only because of the first big spike in VIX since March but also because of the claims that the volume in these ETFs is more than the time period around previous bottoms??

Here is another example with the simple (as opposed to ultra) shorts in S&P and DOW (SH and DOG respectively)

Again the figure compares the total volume traded within three days of Market bottoms in January and March with Mid July. The blue bars represent SH (Short S&P). The red bars represent DOG (Short DOW 30)

Again we see a similar picture. Example a total of about 2.68 million SH shares traded on Jan 18, 22 and 23. A total of about 1.96 million SH shares traded on March 14, 17, and 18. A total of 1.90 million SH shares have traded on July 11,14 and 15.

Conclusion: The panic spike is yet to come unless the obscenely ginormous manipulative power of Feds was successful in the last three days. Which wouldn't make sense because the Fed had more tools back in Jan and March and they still could not prevent the VIX spikes.

Keep in mind we may see a spike as early as tomorrow or as late as August. But based on the above analysis, I am inclined to conclude we have yet to see it.

good luck

Krish

Posted by

Krish R

at

7:10 PM

2

comments

![]()

Monday, July 14, 2008

Still No Time To Be A Hero

Our strategy to remain on sidelines and short the cheaper index puts or buying index ETF shorts keeps on giving! If it wasn't for the enormous amount of government intervention in the last few days, what transpired with the banks, Freddie and Fannie came very close to getting stripped and receiving a kazillion lashes. And there are people who say we are in a free market country. What a joke! I don't know how many times I have uttered those three words in the last one week. Its not even funny anymore.

Only hindsight will tell if the intervention was a brilliant move or a kick in the face of the already fragile economy. I am one of those who believes we may benefit short term but the inevitable financial massacre has just been pushed to a later date and may contribute to an overall Black Swan incident. I hope I am wrong. But for now I am waiting for a bottom, not anticipating ..just waiting. I will start anticipating when I get my sentiment indicators high enough. With all due respects, am not stupid or stupidly rich enough to be a hero.

As I have said in the previous posts, I have taken half off my index puts or index shorts for profits and am letting the other half ride. I am STILL NOT opening any new long positions. But I will start studying and researching companies for some nice new long positions this week. The source energy aka God aka the Force aka the High aka the Feeling-You-Get-When-You-Put-A-Swab-In-Your-Itchy-Ear orchestrates such boring, mundane, drawling, slow-motion-train-wrecking and gut wrenching times for a reason - So that we can sit back on a lazy Tuesday evening and ask ourselves - while chickens are running with their heads cut off, what sweet stock/option is going to deserve my well deserved mint for the next couple of months?

Good luck

Krish

Posted by

Krish R

at

5:13 PM

0

comments

![]()

Tuesday, July 8, 2008

The Week of Reckoning

I had some market index shorts in the form of S&P puts open since the last few weeks as mentioned before in this blog. I had anticipated the market fall and the strategy worked out well. While my long portfolio was water tortured by Mother Market, thankfully due to the shorts, I didn't fall off the cliff. I will be covering my shorts this week. So that you know. My theory is - although the bloodbath has continued, the final reckoning I am awaiting for should happen this week. Expect major spikes in VIX and/or a panic sell-off this week. There is no other way except for this grand climax. Just in case it doesn't happen due to some stupid reason like interventions, I want to book my profits while I am still very sure about my shorts. Besides, the level of speculation would increase to a degree that would be too uncomfortable for me to continue betting on the short side until the indicators become slightly less oversold or we continue on the next leg down. For now though, I am going in for the kill and I will be ready on the other side.

The google trends indicator mentioned couple of posts ago in combination with the VIX study and other indicators reflecting institutional participation or lack thereof, worked out really well allowing me to not to sway with the talking heads who have been calling a bottom since the last twenty sessions. Yeah..same sessions marking the market's continued obscene decline.

A great post from Dr Bret Steenbarger published today resonated with me. Dr Steenbarger surmises that by tracking certain sectors' ETFs you can get a good idea of whether the market is in a recessionary/risk-averse mode or recovery mode. The former would pursuade the participants to move to defensive stocks like consumer staples. The latter would encourage the participants to move to stocks that have been battered off late such as financial stocks. If my theory about the week of reckoning is correct, then in addition to watching for a panic sell off, I like Doc's idea to study the sectors to understand if we have truly come on the other side. If so, I may be interested in getting long some of the financial stocks later this week or early next week.

Good luck

Krish Rathi

Posted by

Krish R

at

12:31 AM

0

comments

![]()

Tuesday, July 1, 2008

Lack of Fear (you read it here first!)

About a week and a half ago, I surmised how lack of fear is indicating the markets have still ways to go down using Google Trends indicator. While we saw that prediction unfold, many writers in financial publications and blogosphere also started talking about VIX and its inherent complacency off late.

Moving on, the markets remain in extreme oversold condition, and yet VIX remains stubbornly complacent. Even the google trends indicator discussed last week has remained flat to down. However lets not forget the seasonality. With the summer going on and lot of people taking off on vacations, the following of the markets and participation in them tend to thin down a bit. So a skeptic of VIX indicator might argue if there are not enough people, who is going to panic? On the other hand, a record outflow of money from Funds have been reported last week. So there is certain amount of wariness to keep money invested in the Equities.

I remain on sidelines. Anticipating the recent sell off, I had scooped up a few S&P puts in my personal portfolio that kept me from falling off the cliff in the recent bad days. You may want to buy some puts too as a hedge protection should the markets try to make another go at the trajectory down. These usually can be slightly pricier in this kind of a market as opposed to buying slightly out-of-money VIX options one or two months away. If you are not an options trader and more of a stocks investor/trader, then there are several ultra short ETFs to pick from as a good hedge.

Posted by

Krish R

at

1:31 AM

0

comments

![]()

Sunday, June 22, 2008

Market's Schizophrenia

Sorry for the gap recently. I am back!

The markets continue their Schizophrenia. In the last post I had surmised that March had put in some sort of tradeable bottom. That strategy worked great all the way till Mid May. In my prior posts late last year and earlier this year, I had warned that if there is a second shoe, then there has to be a third and a fourth and more. Well the sound of the falling knife is really the sound of those remaining shoes dropping, with most of the bad news coming from financials. As a result, the worst performing sector this year has been financials followed by housing. As a trader it is my job to identify opportunities where we can still make money with an in and out strategy, but as a long term investor I continue to remain on the sidelines as I had surmised back in January.

Right now my trading bets are small with extreme precision. I am not casting a big wide net because the market fluctuations and less capital don't allow that kind of luxury at least for now. But hey..when did that stop us?

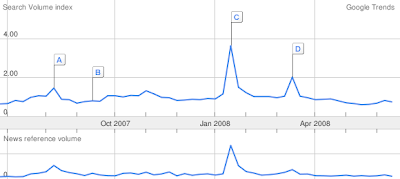

Here is something interesting that I discovered while perusing Google trends. Google trends is a tool publicly available to see how hot is a given search word or a phrase. I put in the words "Stock Markets" in this tool and I got the below chart.

Notice the spikes closely related to the big plunges in the market. For example C is right around the Jan 22 bottom and D is right around the March 17 bottom. I wouldn't call it a 100% reliable indicator but it sure gives an idea of investor sentiment. The bigger the spike, the bigger the fear/concern and hence more chances the market may put some kind of a bottom. Lets see when the next spike comes in.

Speaking of plunges, this coming week is interesting. Expect a blood bath this week possibly earlier than later, but also expect some big swings on the upside as well. You are smiling if you are a day trader. You are cursing if you are an investor or a position trader. Either way, we will keep treading the markets carefully. So caution is still the name of the game. Will send out picks if I pick any interesting scan. But this is it for now. I am glad to be back.

Krish Rathi

(Update to the above post: I got a comment from an "anonymous" reader that my use of the term "Schizophrenia" that seem to imply I was disregarding the real definition of the term and may have been indifferent to the real plight. He also said "two identities" is not a symptom of Schizophrenia, which is what he thinks I was implying in the post above. First off, I apologize if my usage of the term has upset anyone. I have used it pretty much as a metaphor as English speaking journalists the world over use it to describe fairly different situations. I could have done a better job to describe the context. Let me take another shot. My context here refers to that particular symptom of schizophrenia which deals with perceptions of reality that are strikingly different from the reality seen and shared by others around them. Living in a world distorted by hallucinations and delusions, schizophrenia induces fright, anxiety and confusion. In that regards, I feel the markets has come close to demonstrating these features. First off, the credit crisis was completely underplayed, underestimated and as the shoes kept dropping, the markets have panicked when reality collided with the perceived view back in October and even in January, times when the prevailing notion was that all the skeletons are out of the closet, only to be met by surprises. Not only that, every day the economic data gets even superficially better, the market is very eager to forget the underlying bad news and rally on things like a revered talking head thinking we have reached the bottom of a particular sector, the government officials talking up the dollar, so on and so forth. Next day, reality kicks in with some bitter news about a bank restating their write downs, and the market dives down making you wonder why did it even went up in the first place. This to me does sound like a case of living in hallucination with all due respects. I certainly recognize the seriousness of the disease and don't wish to belittle its gravity. Its a metaphor in this context pretty much like "bastardization". I thank the anonymous reader for giving me this opportunity to research more on this disease, clarify and I hope he understands my intention.)

Posted by

Krish R

at

9:37 PM

2

comments

![]()

Thursday, April 10, 2008

Taking some profits off the table

The Markets did catch a great tradeable bottom! And they are still feeling pretty good. The monthly charts on S&P did a remarkable bullish hammer formation for March. In plain english it means there is a good chance the Market put an intermediate term bottom in March. This could be confirmed if April candles paint a bullish formation as a confirmation to March action.

The VIX trade published here and the ISRG trade published here did par excellence! I am closing my VIX trade for a profit of 94.67% and selling half off on ISRG for a profit of 170.56% today!

Is ISRG still a buy?

I think yes. And that is the reason why I sold only half of ISRG. The charts are quite bullish. What makes it extremely interesting is the earnings events on April 18th. I am betting on the upside.

Trade details

(1) Closed VIX (+VIXPF Option) at $7.30 (Purchase price $3.75)

(2) Closed Half off ISRG (+AXVDA Option) at $48.70 (Purchase price $18)

Good luck

Krish Rathi

Posted by

Krish R

at

11:00 AM

0

comments

![]()